Few industries evolve as quickly as gaming. Players demand new experiences every year. Developers constantly push technical and artistic boundaries.

Over the last five years, mobile games have not only taken market share from PC and console games, they’ve also expanded the global market itself. In 2018, mobile games commanded 51% of the gaming market. In 2019, that’s expected to increase to 54%. By 2021, it will reach 59%.

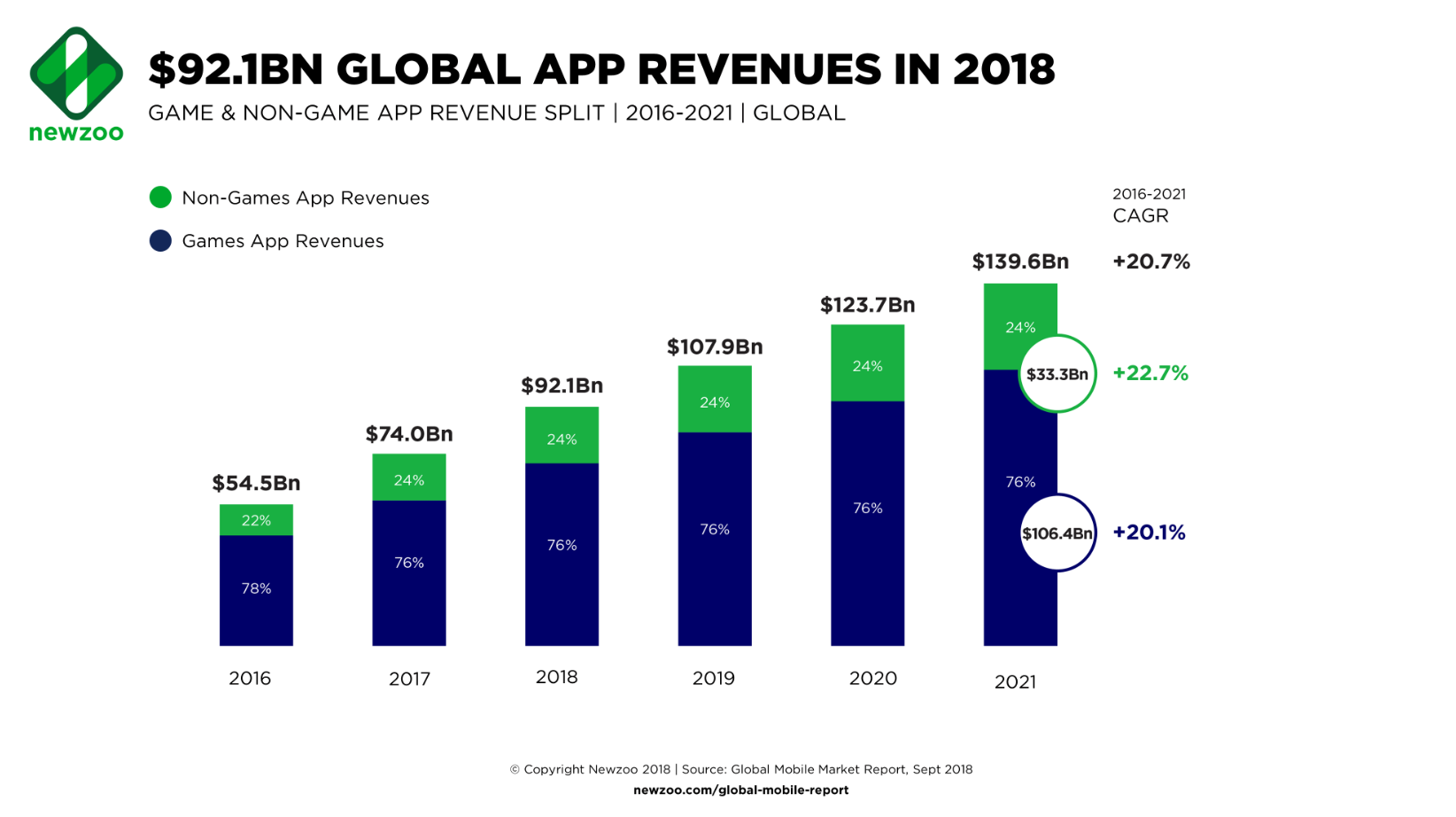

Game revenue is expected to rise as well. In 2017, mobile game revenue hit $50.4 billion. In 2019, game revenue will represent 76% of all app revenue, which is about $82 billion.

While the mobile F2P games market will undoubtedly amass more players and collect more revenue, that begs the question: In what ways will it change this year?

In this article, we’ll lay out our mobile F2P gaming predictions for 2019. We believe these trends will emerge over the coming months as the industry evolves.

More Hyper Casual Games

“It’s not hard to understand why many game studios are joining this trend: right now several top free games in the App Store are hyper-casual,” says Lab Cave CMO Enric Pedró.

Hyper casual games are usually free and easy to play. The principles are simple and quick to learn. Since they are monetized with ads, their core loops are basic and straightforward.

The simplicity of hyper casual games means players can vary the lengths of their play sessions. They can play for just a few moments while they sit in a waiting room or for an hour in the evening. High replayability means players return to the game for instant enjoyment.

Furthermore, hyper casual games typically have low costs per install and require a short production time, which means they cost less to produce then typical free-to-play games. They don’t risk much if a game doesn’t perform well. This also means a studio can develop games quickly (often in just a few months) or at the same time. Even the least polished AAA titles can take a few years to develop.

In 2019, we expect larger, established gaming companies will invest in more hyper casual titles, either by developing their own games or acquiring smaller companies who specialize in the space. We expect developers to focus on user acquisition, retention (beyond Day 7), and better monetization through ads.

The Reign of Content

In 2019, we predict that discovery will play a smaller role in game industry. Instead of exploring new games, players will spend more time and money in the games they already play. They won't mind playing the same games because those games will continue to release fresh content.

This means the industry will continue to be dominated by a small number of big hits, like Fortnite, Candy Crush, and Clash Royale. Games with strong IP, brand recognition, and a robust live ops program will get a disproportionate amount of attention.

Higher retention and healthier monetization means big games can invest more in live ops, which fuels better retention and monetization… These compounding network effects entrench big games in the top of their categories, making competition exceedingly difficult.

Catering to Asian Markets

Asian markets are rapidly growing opportunities for F2P games. Mobile game revenue in Japan is expected to reach $6.5 billion in 2019. China should hit $21 billion in 2019.

India, an emerging market, will break $1 billion in 2019. India presents a considerable opportunity because phones are cheap. Gamers are more likely to play on phones than PCs or consoles.

In 2019, not only do we expect to see western games modified for eastern audiences, we also expect to see plenty of western publishers expand into Asian markets, particularly China and India.

App Store Abandonment

At the end of 2018, Epic Games caused a stir by announcing that Fortnite for Android soon wouldn’t be available on Google Play. Epic intends to launch Fortnite as an external app that users will download and install directly from their browser.

This is a bold move from Epic Games. Typically, distribution through an app platform like Google Play or Apple's App Store is considered the only way to gain popularity. In the case of Fortnite, however, Epic Games is clearly confident that they don’t need the boost from Google. In fact, Epic’s CEO Tim Sweeney said they would pull out of the App Store if Apple’s ecosystem wasn’t closed.

Why are they doing this? Probably to avoid Google’s 30% fee. Considering Fortnite’s massive revenue, that amounts to hundreds of thousands of dollars per day. It may also help them expand in China where the Android market is deeply fragmented.

Nevertheless, there are challenges to this kind of distribution model. For one, players who install an Android app from their browser we'll have to dig into their security settings and enable installations from “unknown sources.” For another, installing outside of Google's ecosystem makes apps subject to viruses and hacks.

If this strategy works for Epic, we might see other popular free-to-play games with strong brands attempt to publish off Google Play. Whether they’ll be successful, however, is unknown.

Console-Quality Games

Hardcore gamers have dismissed mobile games as being too simplistic, unengaging, and devoid of features, but that’s changing.

If you browse the App Store, you’ll notice a distinct rise in quality of some of the latest games. For instance, there’s Godfire: Rise of Prometheus (Android | iOS):

As mobile hardware continues to advance, developers will have more flexibility to create faster, higher quality games comparable to console titles. Streaming tools like Microsoft’s Project xCloud, Google’s Project Stream, and EA’s Project Atlas are in development to make console-quality titles available on any device, even if the device doesn’t have the specs to run it.

Augmented Reality Gaming

AR gaming was thrust into the spotlight with Pokemon GO, but it’s not the only game to use the real world as in-game content. Ghostbusters World, Jurassic World Alive, and The Walking Dead: Our World have all tried to capitalize on augmented reality. None were as successful as Pokemon GO, but it shows that developers are experimenting with the technology.

In 2019, we expect to see more AR games that not only include visual elements from the real world, but also audio and social elements. Furthermore, we may see AR games that aren’t backed by dependable IP.

Cross-Platform Play

Games that acquire players quickly benefit from network effects. As a game’s player base increases, new players are more likely to try it out and existing players are more likely to stick around. After all, who wants to leave the game all their friends play?

By releasing games across multiple platforms, developers empower their ability to acquire new players. If you can find your way around the technical limitations of multiple platforms, you can publish a game with maximum accessibility.

Games like Fortnite and PUBG made cross-platform gameplay popular, but there are dozens more. We expect to see even more in 2019.

Shift from Whales to Minnows

The free-to-play model has a tendency to focus on whales - the small percentage of players who spend a lot of money in F2P games. Getting whales to open their wallets can be the difference between success and failure.

In 2019 and beyond, we expect publishers to take a more granular approach to retention and monetization, whether they make money through in-game advertising or in-game purchases. This might include deeper segmentation to offer personalized promotions or more sophisticated behavior tracking to time offerings.

Stay Ahead of the Curve

Hopefully our predictions give you some insight into the F2P landscape over the coming months and years. Consider how you could build these predictions into your app to position your game at the front of the pack.

Want more insight? Listen to Playmakers - The Game Industry Podcast

Practical interviews with the legends and leaders of the video game industry